Until now, crypto has been about as useful for daily life as a gold bar in your pocket. Sure, it’s fun to watch the numbers go up and down while pretending to understand blockchain, but actually spending it? That required more steps than assembling IKEA furniture while hungover.

PayPal just changed the game. The payment giant is bridging the gap between crypto fantasies and real-world spending, letting you finally use that Bitcoin stash for something more exciting than bragging rights. No shady exchanges, no wallet addresses that look like they were generated by a cat walking on a keyboard. Let’s break down how Crypto on PayPal works.

- App PayPal Honey: La vostra guida alla spesa intelligente

- Amazon Prime Benefits: What You Really Get in 2025

- Crypto Wallet Apps: Secure and Manage Your Investments in 2025

How PayPal Crypto Payments Actually Work

Forget everything you know about complicated crypto transactions. PayPal’s system is so simple, even your technophobic aunt could use it:

- Automatic conversion: your crypto converts to fiat at checkout (no gas fees or waiting);

- Full purchase protection: same buyer safeguards as regular PayPal payments;

- No wallet management: PayPal handles all the blockchain mumbo-jumbo behind the scenes;

- Instant merchant payout: businesses receive normal currency (they’ll never know you paid in crypto);

- Supported coins: Bitcoin, Ethereum, Bitcoin Cash, and Litecoin (for now).

As PayPal’s official crypto page explains, this isn’t some limited beta—it’s available to all eligible U.S. accounts right now.

PayPal’s mobile app is compatible with both iOS e Android and provides users with a recognizable checkout process while managing all the blockchain complexities in the background.

PayPal protects merchants from volatility by instantly converting your digital assets to fiat at competitive rates when you choose cryptocurrency as your payment method.

4.7/5

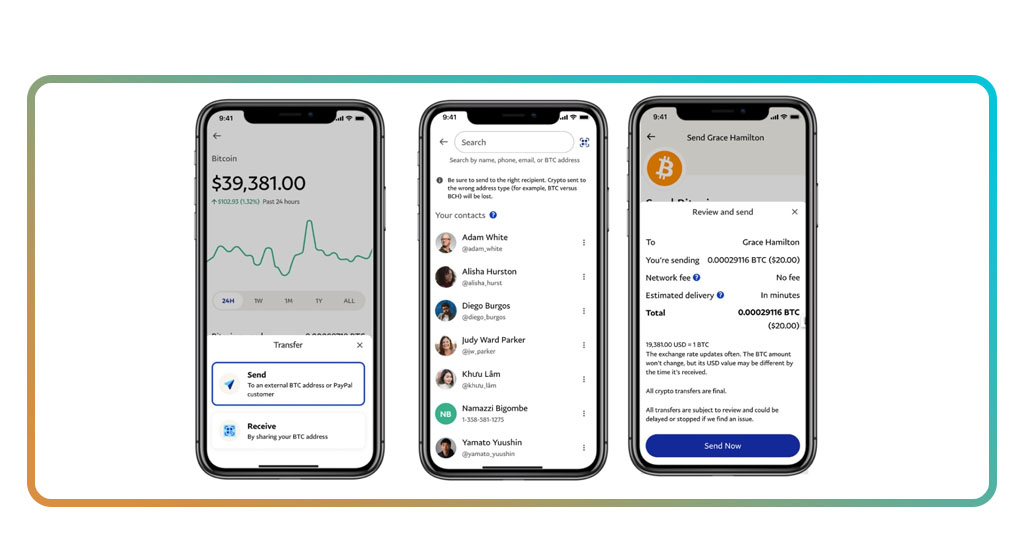

Pay With Crypto on PayPal in 3 Simple Steps

Turning your digital wealth into actual purchases is embarrassingly easy:

- Enable crypto payments in your PayPal wallet settings (one-time toggle);

- Select crypto at checkout when shopping at millions of PayPal merchants;

- Confirm the conversion rate and complete your purchase like normal.

That’s it. No copying wallet addresses. No waiting for blockchain confirmations. No panicking when you realize you sent Ethereum to a Bitcoin address.

The Perks of Using Crypto for Everyday Shopping

Getting more value out of cryptocurrency is more important than simply spending it:

- Cashback rewards in crypto for eligible purchases (yes, really);

- No conversion fees when spending directly versus cashing out first;

- Tax advantages in some jurisdictions (spending vs. selling counts differently);

- Early access to exclusive merch drops and experiences for crypto users;

- Portfolio diversification without needing to liquidate holdings.

And since nothing says “mainstream adoption” like using Bitcoin to purchase socks, PayPal is implementing crypto-only discounts at major retailers.

What This Means for Crypto’s Mainstream Adoption

PayPal’s move is bigger than just another payment option:

The merchant avalanche effect

Small businesses have avoided crypto like it’s a Nigerian prince email for good reason:

- No more volatility risk: merchants get paid in stable fiat while you spend crypto;

- Zero blockchain learning curve: existing PayPal integrations work automatically;

- Fraud protection they understand rather than irreversible crypto transactions;

- Customer demand will force adoption as users expect the crypto payment option.

According to industry analysts, by 2026, 65% more online retailers will accept cryptocurrency payments indirectly through PayPal—not because they are interested in blockchain, but rather because it’s just another option in their PayPal settings.

Regulatory game changer

Governments have treated crypto like the sketchy guy at a yard sale, but PayPal changes that:

- KYC/AML compliance is baked in (no anonymous crypto spending here);

- Tax reporting happens automatically for U.S. users;

- Consumer protections align with traditional finance standards;

- Institutional credibility makes regulators breathe slightly easier.

Legislators are forced to stop treating digital currencies like illegal goods when PayPal, a business that goes above and beyond for regulatory compliance, places its stamp on them.

From speculative asset to spending money

This kills two crypto adoption barriers in one move:

- Actual utility transforms crypto from “magic internet money” to something that buys actual magic (or at least Amazon products);

- Price stability increases as more coins circulate in commerce rather than sitting in speculative wallets;

- Mainstream perception shifts from “risky investment” to “useful payment method”;

- Network effect kicks in as more spending drives more merchant acceptance.

Our cryptocurrency investing guide shows how this creates a virtuous cycle where increased utility could actually reduce crypto’s notorious volatility over time.

The psychological tipping point

There’s something profoundly different about buying coffee with Bitcoin when:

- Your receipt looks normal (no blockchain jargon);

- Customer service exists if something goes wrong;

- Your parents could do it without calling you for tech support;

- It’s just another payment option rather than a political statement.

This is normalization, not merely adoption. Furthermore, perception frequently turns into reality in financial markets more quickly than blockchain confirmations.

Even though they didn’t create cryptocurrency, crypto on PayPal may finally make it uninteresting enough for Grandma to use, which is exactly what the area needs.

See their official crypto roadmap for a comprehensive overview of the direction that cryptocurrency is taking after PayPal’s integration.

There’s no denying that the question of “when will crypto go mainstream?” has been answered.

4.7/5

Use your crypto to shop like never before

Crypto’s status as a speculative asset is coming to an end. PayPal’s system enables your digital coins to do what money is meant to do: purchase goods.

Visit PayPal’s official crypto help section for comprehensive information on permitted purchases and limits. The internet has been waiting for this moment for fifteen years, so go ahead and spend that Bitcoin.