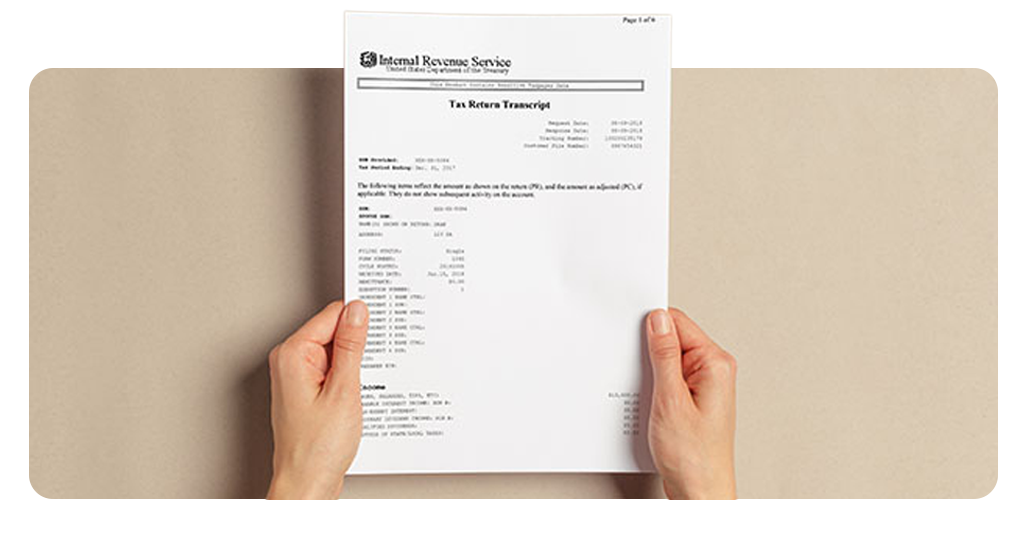

Most people only think about the IRS once a year—during tax season, when stress levels rise and coffee sales spike. But your tax records don’t just vanish into the abyss after you file. They’re stored, neatly, in a document called a tax transcript. Now, before you roll your eyes, tax transcripts aren’t just boring paperwork.

They’re financial proof you’ll likely need for student loans, mortgage approvals, or even government applications. And here’s the good news: you don’t need to drown in red tape to get one. The IRS actually lets you grab your IRS tax transcript online for free, with just a few taps.

- Tax Season: AI Tools to Maximize Your New Energy Credits

- Digital Nomad Tax Guide: Simplifying Global Tax Compliance

- Sie machen Ihre US-Steuererklärung? Diese Apps können helfen!

Why tax transcripts are important for loans and applications

Think of a tax transcript as your financial report card. It’s not a copy of your full tax return, but rather a condensed version showing key data: your income, filing status, and any adjustments.

Lenders, schools, and government offices ask for these documents because they come directly from the IRS. Translation: they trust them more than your own printouts.

Here’s where you’ll need an IRS tax transcript:

- Applying for federal student aid or university admissions;

- Securing a mortgage or refinancing your home loan;

- Getting approval for a car loan or personal credit;

- Verifying income for rental agreements or government benefits;

- Filing amended returns or catching errors on past filings.

If money is involved, there’s a decent chance someone will ask you for this document.

Get your IRS tax transcript online without hassle

Gone are the days of waiting weeks for mail or spending hours on hold with the IRS. Today, you can grab your IRS tax transcript instantly via their secure online system or through the official IRS2Go app.

There are two main ways to do it:

- IRS website: head to the Get Transcript page and log in to your online account. From there, you can view and download transcripts going back several years;

- IRS2Go app: if you prefer mobile convenience, download the app and access your transcript after verifying your identity. It’s fast, free, and avoids unnecessary trips to an IRS office.

Both methods offer the same result—secure access to your records. And yes, you can print or save them as PDFs for later.

Step-by-step: how to request a transcript in IRS2Go

Setting it up might sound intimidating, but the process is actually simple. Here’s your walkthrough:

- Herunterladen IRS2Go for Android oder iOS;

- Open the app and create a secure IRS account if you don’t already have one;

- Verify your identity with personal information, such as Social Security number and filing details;

- Select “Tax Records” to request an IRS tax transcript;

- Choose the year you need and view it directly in the app or save it to your device.

The entire process takes less than 10 minutes. No phone calls, no office visits—just direct, official data straight from the source.

Extra features: refund tracking and payment options

While the main draw is the ability to check your IRS tax transcript, IRS2Go isn’t a one-trick pony. The app packs a few extra tools that might save you time and headaches:

- Refund status tracking: check where your refund is in the IRS system;

- Secure tax payments: make direct payments without third-party platforms;

- Tax help resources: access IRS updates, tools, and official guides.

It’s like carrying a mini IRS office in your pocket—minus the long lines and endless waiting.

Download IRS2Go for secure access anytime

Die IRS2Go app is the official mobile companion of the IRS. It’s lightweight, easy to navigate, and trusted by millions.

Plus, since it comes directly from the IRS, you don’t have to worry about shady third-party apps mishandling your data.

Here’s a quick look:

When it comes to sensitive information like your tax history, security is non-negotiable. IRS2Go uses encrypted connections and multistep identity verification to keep your data locked down.

Common mistakes people make when requesting transcripts

Even with a streamlined system, some taxpayers still stumble. Avoid these mistakes when retrieving your IRS tax transcript:

- Using outdated personal info (like an old phone number or address);

- Forgetting that transcripts only go back a certain number of years;

- Confusing transcripts with full tax returns—they’re not identical;

- Not checking the type of transcript requested (there are Return, Account, Record of Account, and Wage & Income versions);

- Assuming the process affects your credit or refund—it doesn’t.

The fix is simple: double-check your details before hitting submit, and know exactly which transcript type your lender or institution requires.

Why IRS transcripts beat DIY records

Sure, you might already have copies of your tax returns sitting in a folder at home. But lenders and universities often insist on IRS transcripts instead. Why? Because they want proof straight from the source, untouched by you.

By requesting an IRS tax transcript, you’re essentially showing them: “Here’s my data, verified by the IRS”.

That credibility can fast-track approvals and prevent delays. In other words, your transcript is financial shorthand for “no funny business”.

Final thoughts

Taxes aren’t anyone’s idea of fun, but access to your records doesn’t need to be a nightmare. With tools like IRS2Go and the official IRS Get Transcript service, grabbing your IRS tax transcript is quick, safe, and—most importantly—free.

Whether you’re applying for a mortgage, securing financial aid, or just double-checking your records, this simple step saves you time and gives you peace of mind.

No paperwork piles, no confusing processes. Just official IRS data, right when you need it.

So, stop stressing and start tapping. Download IRS2Go and access your transcript today. Your loan officer—or college admissions rep—will thank you later.